SK Telecom Wins Big: 160K KT Customers Switch

Over 216,000 Subscribers Flee KT in 10 Days—74% Choose SK Telecom

The telecom battlefield in South Korea just witnessed a stunning power shift. SK Telecom scooped up roughly 160,000 subscribers from rival KT Corp in just 10 days, capturing a massive 74.2% of fleeing customers. This subscriber stampede marks one of the most dramatic customer migrations in South Korean telecom history.

The numbers paint a clear picture. Between December 31 and January 11, more than 216,000 KT users ported their numbers to competing carriers or mobile virtual network operators. The exodus accelerated dramatically as the deadline approached, with Saturday alone seeing 33,305 users bolt from KT.

What Sparked This Massive Migration?

KT’s decision to waive early termination fees triggered this subscriber earthquake. The fee waiver came as a response to a major data breach that resulted in unauthorized mobile payments affecting some customers. The company offered subscribers the chance to terminate their services at no penalty until Tuesday, January 13.

The Korea Telecommunications Operators Association data revealed that departures topped 100,000 within the first week alone. By Saturday, daily switching exceeded 30,000 for the first time. That single day saw over 22,100 users choose SK Telecom, while about 8,000 joined LG Uplus and roughly 3,000 shifted to mobile virtual network operators.

SK Telecom’s Aggressive Play Pays Off

SK Telecom didn’t just wait for customers to arrive. The No. 1 mobile carrier rolled out aggressive incentives that made switching irresistible for many KT users. The company offered to restore previous tenure and T Membership benefits for returning customers who had canceled their subscription during last year’s fee waiver period.

Industry officials predict SK Telecom will secure between 200,000 to 210,000 KT switchers by Tuesday’s deadline. Analysts suggest this influx could push SK Telecom’s market share toward 39%, though the company still has ground to cover before hitting the coveted 40% threshold.

Based on industry estimates of approximately 57.6 million total mobile subscribers, reaching a 40% share would require about 23 million subscribers. The current gains help, but SK Telecom still needs more momentum to quickly regain that 40% mark.

How This Compares to SK Telecom’s Own Crisis

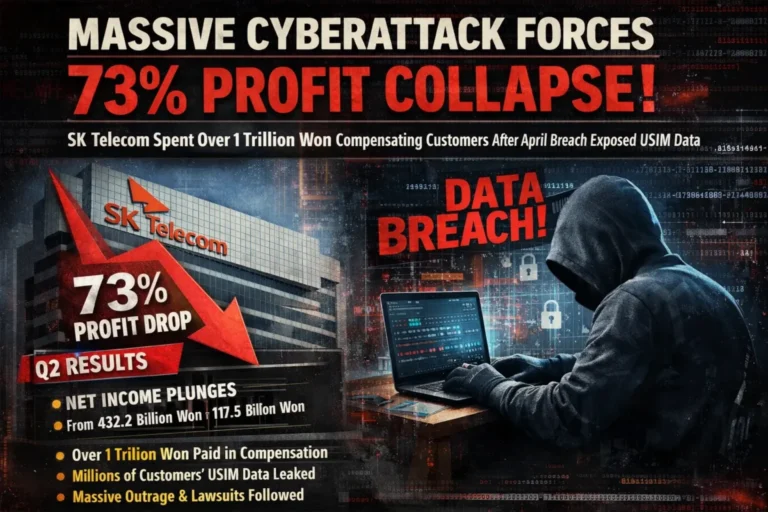

The current KT exodus actually exceeds the subscriber loss SK Telecom experienced during its own universal subscriber identity module breach last year. In July 2025, approximately 166,000 SK Telecom subscribers left the carrier over a 10-day waiver period. KT has now lost roughly 50,000 more users over a similar timeframe.

However, one industry insider noted the complexity of the situation: “It is unlikely that SK Telecom will recover the 40 percent market share, because even before the hacking incident, it was already hovering only marginally above the 40 percent threshold. The number of subscribers who exited SK Telecom since the hacking far exceeds the current KT subscriber churn; the benefit would not be enough to fully offset those earlier losses.”

SK Telecom’s own data breach led the company to roll out a compensation package worth approximately 500 billion won ($340 million) throughout 2025. The company’s market share fell below 40% in May for the first time and has struggled to recover since.

Why Did So Many Choose SK Telecom Over LG Uplus?

Consumer trust played a significant role in the lopsided distribution of departing subscribers. While SK Telecom’s hacking case was largely concluded with the imposition of fines, LG Uplus remains under scrutiny over suspected record concealment.

Industry observers also point to SK Telecom’s customer reacquisition policies as a key factor. The restoration of subscription tenure and membership tiers for returning customers proved especially attractive to former SK Telecom users who had left following last year’s incident.

KT’s Compensation Package Falls Short

KT attempted to stem losses by rolling out a compensation package worth 450 billion won. The package includes extra data allowances, roaming benefits, and free access to streaming services. However, unlike SK Telecom’s compensation approach, the package doesn’t include subscription fee discounts.

The extra data benefit created additional frustration because it doesn’t apply to users on unlimited data plans—who account for roughly 30% of KT’s subscriber base. This limitation drew mixed reactions from customers and may have contributed to the decision by many to switch carriers.

The Security Failures That Started It All

The public-private joint investigation team at the Ministry of Science and ICT released findings stating that KT’s security failures “constitute grounds for a fee waiver for all customers.” The investigation revealed shocking details about the scale of the breach.

KT’s servers showed malware infection across 84 servers with 103 types of code, far exceeding SK Telecom’s hacking case which affected 28 servers with 33 types of code. The investigation confirmed that eavesdropping was possible via illegal micro base stations called femtocells, elevating the severity of KT’s breach.

Investigators discovered that KT’s femtocell authentication system relied on a single manufacturer-issued certificate shared across devices. The joint task force found malware dating back to April 2022, and criticized KT for failing to notify authorities after detecting malicious code in early 2024.

What Happens Next for South Korea’s Telecom Giants?

With the fee waiver deadline set for Tuesday, January 13, the final tally of departing subscribers will soon be clear. Industry watchers expect the exodus to continue accelerating as the deadline approaches, with some predicting daily cancellations could expand into the tens of thousands.

The subscriber reshuffling has significant implications for South Korea’s mobile market structure. SK Telecom gains a temporary boost, but the company still grapples with the long-term effects of its own data breach. KT faces the challenge of rebuilding customer trust while implementing comprehensive cybersecurity reforms.

All three of South Korea’s major mobile carriers faced cyberattacks last year, raising broader questions about the security of the nation’s telecommunications infrastructure. The Ministry of Science and ICT has ordered KT to submit a comprehensive prevention plan by January, with implementation to be reviewed by mid-year.

The Bottom Line

This massive subscriber migration demonstrates how quickly customer loyalty can evaporate in the wake of security failures. KT’s attempt to make amends through fee waivers backfired spectacularly, primarily benefiting its largest competitor. SK Telecom capitalized on the opportunity with strategic incentives, but the gains may not be enough to fully recover from its own previous losses.

The telecom wars in South Korea continue to rage, with customer trust hanging in the balance. As cybersecurity threats evolve and data breaches become more sophisticated, carriers face mounting pressure to protect subscriber information or risk losing millions of customers overnight.

FAQ Section

How many KT subscribers switched to SK Telecom during the fee waiver period?

Approximately 160,000 KT subscribers switched to SK Telecom between December 31 and January 11, representing 74.2% of all users who left KT during this period. This represents a significant customer migration, with industry officials predicting the final count could reach 200,000 to 210,000 by the January 13 deadline. The mass exodus occurred after KT waived early termination fees following a major data breach.

Why did KT waive early termination fees for its customers?

KT waived early termination fees in response to a major data breach that resulted in unauthorized mobile payments and security failures. A public-private joint investigation team found that KT’s security lapses constituted grounds for a fee waiver for all customers. The investigation revealed malware infections across 84 servers and confirmed that eavesdropping was possible via illegal micro base stations. The fee waiver was retroactive to September 1, 2025, and remained in effect until January 13, 2026.

What incentives did SK Telecom offer to attract KT subscribers?

SK Telecom offered aggressive incentives including restoration of previous tenure and T Membership benefits for returning customers who had canceled their subscription during last year’s fee waiver period between April 19 and July 14, 2025. This strategy proved particularly attractive to former SK Telecom users who had left following the company’s own data breach. The incentives helped SK Telecom capture over 74% of departing KT subscribers during the fee waiver period.

Will SK Telecom regain its 40% market share after gaining KT subscribers?

Industry analysts suggest SK Telecom’s market share will likely approach 39% but may struggle to quickly regain the 40% threshold. Despite gaining roughly 160,000 to 210,000 KT subscribers, the number of subscribers who left SK Telecom following its own hacking incident far exceeds the current influx. SK Telecom’s market share fell below 40% for the first time in May 2025 following its universal subscriber identity module breach, and the current gains may not fully offset those earlier losses.