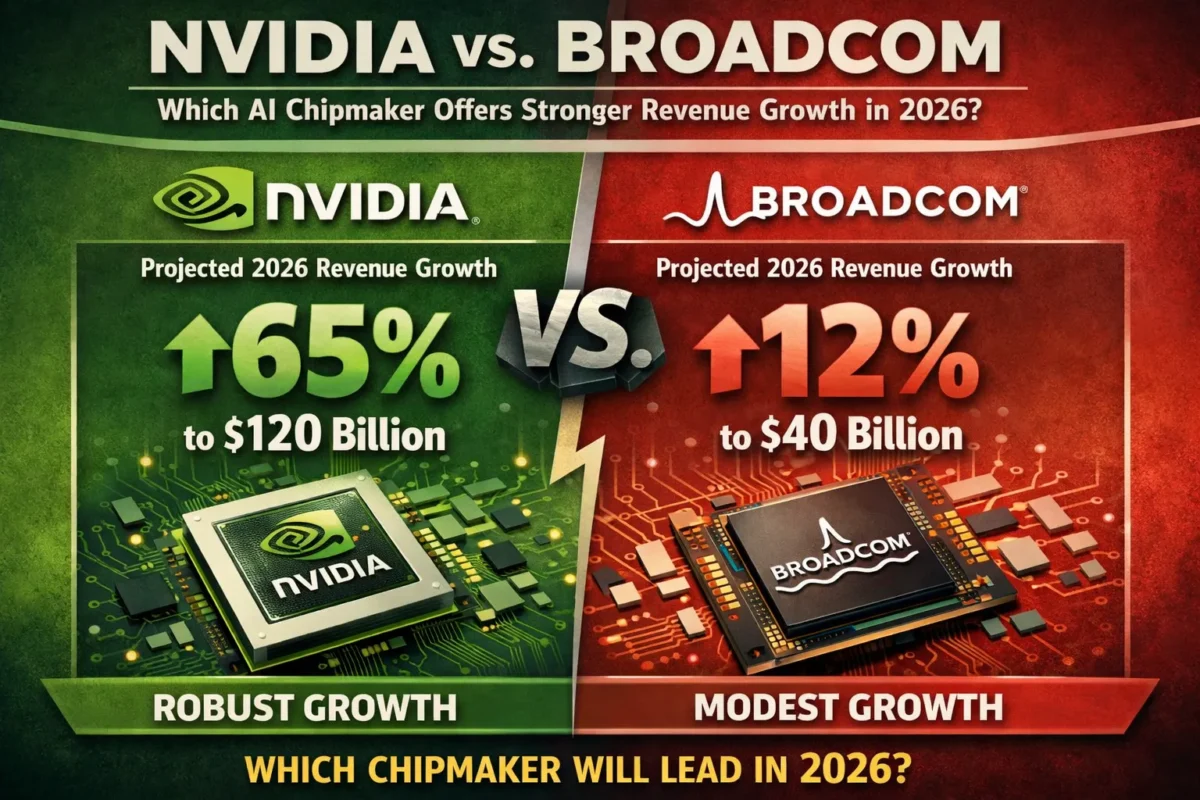

NVIDIA vs Broadcom: Which AI Chipmaker Offers Stronger Revenue Growth in 2026?

The race for AI infrastructure dominance is reshaping global semiconductor markets — and two names are pulling ahead of the field.

As enterprise spending on artificial intelligence accelerates across every major economy, the battle for AI chip supremacy has narrowed to two companies: NVIDIA Corporation (NVDA) and Broadcom Inc. (AVGO). Both firms sit at opposite but equally critical ends of the AI hardware ecosystem, and both are posting revenue figures that would have seemed implausible just three years ago. This analysis breaks down who is growing faster, where margins are heading, and what each company means for global investors and technology markets in 2026.

By the end of this piece, readers will have a clear, data-grounded picture of the revenue trajectories, business model differences, and forward earnings potential that separate these two AI infrastructure giants — without the noise.

Strategic Importance: Why This Comparison Matters Now

The global AI infrastructure build-out is no longer a future event. It is a current capital expenditure cycle that hyperscale cloud operators, sovereign governments, and enterprise platforms are funding at an unprecedented rate. The International Data Corporation projects worldwide AI infrastructure spending to surpass $300 billion by 2027, with semiconductor content representing the largest single cost line.

Within this context, NVIDIA and Broadcom occupy distinctly different but deeply interdependent positions. NVIDIA designs and markets the graphics processing units (GPUs) used to train and run large-scale AI models. Broadcom supplies the networking silicon and custom application-specific integrated circuits (ASICs) that allow data centers to move AI workloads efficiently across thousands of servers. Neither company can be ignored by portfolio managers, procurement executives, or policymakers tracking the digital infrastructure supply chain.

Also Read : Why Verizon, AT&T, and T-Mobile Are Beating the Market in 2026

Business and Revenue Impact: Margins, Growth Rates, and Earnings Power

NVIDIA: Scaling Revenue at a Rate Few Companies in History Have Matched

NVIDIA has grown its revenue base with a velocity that is rare even by semiconductor industry standards. In the third quarter of its fiscal year 2026, the company reported total revenue of $57 billion, representing year-over-year growth of 62 percent. Non-GAAP earnings per share reached $1.30, a 60 percent increase from the same period a year prior.

The engine behind these numbers is the Data Center segment, which generated $51.22 billion in a single quarter — approximately 90 percent of total company revenue. That segment alone expanded 66 percent year over year and 25 percent on a sequential basis, driven by accelerating deployment of its Blackwell GPU computing platform. The Blackwell architecture is currently the primary compute substrate for training and inference workloads across the world largest AI laboratories and cloud providers.

Gross margins remain elevated, underpinned by the pricing power that comes with dominant platform status and constrained supply of advanced silicon at the leading edge of manufacturing. NVIDIA forward earnings per share growth for its fiscal year 2027 is projected by consensus analysts at approximately 57 percent, a figure that places it among the fastest-growing large-capitalization companies in global equity markets.

Broadcom: Custom Silicon and Networking Deliver a Different Kind of Durability

Broadcom reported total revenue of $18.02 billion in the fourth quarter of its fiscal year 2025, up 28.2 percent year over year. Non-GAAP earnings per share rose 37.3 percent to $1.95. While these numbers trail NVIDIA on raw growth rate, they reflect a business model with notably different characteristics — specifically, a high degree of customer concentration paired with extraordinarily deep switching costs.

AI-related revenue at Broadcom grew 65 percent across its full fiscal year 2025, reaching $20 billion. In the first quarter of its fiscal year 2026, AI revenue is expected to reach $8.2 billion, representing a doubling year over year. The company has secured a $73 billion total AI-related order backlog — roughly half of its consolidated backlog of $162 billion — providing multi-year revenue visibility that few technology companies can claim.

Broadcom networking products, including its high-capacity Tomahawk switching line, are deeply embedded in the infrastructure of major hyperscale operators. The $10 billion backlog for AI switching products alone illustrates how mission-critical these components have become for data center operators seeking to eliminate bottlenecks between compute clusters.

Analyst consensus projects Broadcom fiscal year 2026 EPS growth at approximately 50 percent, slightly below NVIDIA but well above the broader semiconductor sector average.

Competitive Landscape: Parallel Tracks, Not Direct Rivals

A common misconception in coverage of these two companies is that they compete head-to-head for the same customer budget. The reality is more nuanced. NVIDIA wins contracts where raw compute power — for model training, inferencing at scale, and generative AI deployment — is the primary requirement. Broadcom wins contracts where data movement, network fabric efficiency, and workload-specific acceleration are the priority.

However, competition is intensifying on the margins. Broadcom custom ASIC business is explicitly designed to help hyperscale customers build AI accelerators that reduce their dependence on merchant GPU supply — directly nibbling at NVIDIA addressable market over a multi-year horizon. Google Tensor Processing Units and similar internally developed silicon, often built with Broadcom design and manufacturing support, represent the clearest expression of this dynamic.

NVIDIA response has been to deepen its software ecosystem through CUDA and its growing suite of enterprise AI platforms, making it more difficult for customers to migrate workloads even when alternative hardware becomes available. This software-driven lock-in is a structural competitive moat that Broadcom, as a pure hardware and networking supplier, does not replicate in the same way.

AMD remains a distant third in AI GPU supply but is gaining share in inference deployments. Intel AI chip efforts have yet to achieve meaningful scale. Neither poses a near-term threat to the leadership positions held by NVIDIA or Broadcom in their respective market segments.

Analyst Perspective: Valuation and Forward Returns

From a valuation standpoint, NVIDIA currently trades at a forward price-to-earnings multiple of approximately 24.76 times, while Broadcom trades at around 28.66 times forward earnings. This means investors are paying a higher earnings multiple for Broadcom despite the fact that NVIDIA forward earnings growth rate is materially superior.

This apparent premium in Broadcom valuation likely reflects two factors: the relative stability and predictability of its order backlog, and the recurring nature of software revenue from its infrastructure software division — a segment that generates high-margin maintenance and subscription income entirely separate from AI silicon. For income-oriented institutional investors and total return funds, this blend of hardware and software recurring revenue commands a structural premium.

For growth-oriented investors with a 12 to 24 month horizon, the consensus view leans toward NVIDIA as the higher-conviction position, given its stronger earnings acceleration, dominant GPU supply position, and the capital expenditure commitments already made by major cloud operators that will flow directly into NVIDIA revenue over the next two to four quarters.

Neither stock is cheap on an absolute basis, but both trade at premiums that, by historical precedent, have been warranted when the underlying revenue growth rate is sustained.

Market and Consumer Impact: Beyond the Stock Price

The financial performance of NVIDIA and Broadcom has consequences that extend well beyond equity portfolios. For global technology infrastructure, the pace at which both companies can ramp silicon supply directly governs how quickly enterprises, governments, and researchers can deploy capable AI systems.

NVIDIA partnership with OpenAI and its involvement in large national AI data center projects — including infrastructure programs in the United States, Middle East, and Southeast Asia — means its revenue trajectory is increasingly intertwined with sovereign technology policy. Constraints in GPU supply translate directly into delayed deployment timelines for healthcare AI, climate modeling systems, financial risk platforms, and autonomous systems development.

Broadcom role as a supplier of networking infrastructure means that every major cloud expansion — whether in Northern Virginia, Frankfurt, Singapore, or Tokyo — requires its components. Its 128G Fibre Channel platforms and PCI Express switching products are embedded in the physical backbone of the global digital economy.

For consumers and businesses that rely on AI-powered services, the financial health and capital reinvestment capacity of these two firms is not an abstraction. It is the material condition that determines whether AI applications improve in capability, latency, and cost over the next three to five years.

AEO: 4 Quick-Answer Questions

Q: Which company has faster revenue growth in 2026 — NVIDIA or Broadcom? NVIDIA. It posted 62 percent year-over-year revenue growth last quarter versus Broadcom at 28 percent.

Q: Does Broadcom compete directly with NVIDIA? Not directly. NVIDIA dominates AI compute. Broadcom leads AI networking and custom chips. They serve the same data centers but fill different roles.

Q: Which stock has better forward earnings growth? NVIDIA. Analysts project roughly 57 percent EPS growth for fiscal 2027 versus about 50 percent for Broadcom fiscal 2026.

Q: Is Broadcom a safe long-term AI investment? Yes, for different reasons. Its $73 billion AI order backlog and software recurring revenue give it multi-year visibility that pure hardware companies rarely have.

References

- Zacks Investment Research via Yahoo Finance — NVIDIA vs. Broadcom AI Chip Stock Analysis (February 2026): https://finance.yahoo.com/news/nvidia-vs-broadcom-ai-chip-151700936.html

- Zacks.com — NVIDIA vs. Broadcom: Which AI Chip Stock Is the Better Buy Now?: https://www.zacks.com/stock/news/2869796/nvidia-vs-broadcom-which-ai-chip-stock-is-the-better-buy-now

- NVIDIA Corporation Investor Relations — Fiscal Q3 2026 Earnings Release: https://investor.nvidia.com

This article is produced for informational purposes only and does not constitute financial or investment advice. All figures are sourced from publicly available financial disclosures and analyst consensus data.