AT&T Targets High-Value Customers With Exclusive Smartphone in Strategic Push

AT&T has introduced an exclusive smartphone offering designed specifically for its most valuable subscriber base, marking a notable shift in how major telecommunications providers compete for market share in an increasingly saturated wireless industry. The initiative represents a calculated bet that product differentiation, rather than price competition alone, can drive customer loyalty and revenue growth in mature markets.

The nation’s third-largest wireless carrier by subscribers is positioning the exclusive device as a retention tool for high-spending customers while simultaneously attempting to attract competitors’ premium users. Industry observers view the move as part of a broader strategic evolution among telecom operators seeking to escape commoditization pressures that have squeezed margins across the sector.

Strategic Positioning in Premium Segment

The exclusive smartphone strategy targets subscribers who generate substantially higher average revenue per user (ARPU) compared to the broader customer base. These premium customers typically subscribe to unlimited data plans, add multiple connected devices, and show lower price sensitivity—characteristics that make them particularly valuable in an era where customer acquisition costs continue climbing.

Telecommunications analysts note that carriers have struggled to differentiate their service offerings beyond network quality and coverage, which have largely converged among major providers. By creating exclusive hardware partnerships, AT&T aims to establish tangible differentiation that extends beyond promotional pricing or temporary service bundles.

The approach also addresses churn reduction, a critical metric for wireless operators. Retaining existing high-value customers costs significantly less than acquiring new ones, and exclusive device offerings create an additional barrier to switching carriers. When premium subscribers invest in carrier-specific hardware, they become more embedded in that ecosystem, potentially reducing defection rates.

Also Read : Amazon and AT&T Join Forces to Bring Satellite Internet to America Most Remote Corners

Revenue and Margin Implications

From a financial perspective, the exclusive device strategy carries implications for multiple revenue streams. Beyond standard service fees, carriers typically earn margins on device sales, accessory purchases, and insurance programs. Premium smartphones command higher price points, which can translate to improved per-transaction economics even when carriers subsidize portions of the device cost.

The initiative also supports AT&T’s efforts to migrate customers toward higher-tier service plans. Exclusive devices often pair with premium data packages, creating opportunities for the carrier to increase monthly recurring revenue while justifying the additional cost through enhanced device access.

Wall Street analysts monitoring the telecommunications sector have increasingly focused on ARPU trends as subscriber growth has plateaued across the industry. Strategies that successfully elevate average customer spending without proportionally increasing network infrastructure costs tend to generate favorable margin expansion—a key driver of equity valuations for mature telecom operators.

Competitive Dynamics and Market Context

AT&T’s exclusive device initiative emerges against a backdrop of intensifying competition in the premium wireless segment. Rival carriers have employed various strategies to attract and retain high-value subscribers, from unlimited data plans to entertainment bundle offerings and preferential device financing terms.

The competitive landscape has witnessed carriers increasingly partnering with device manufacturers on exclusive models or limited-availability variants. These partnerships allow telecom operators to create temporary market advantages while providing manufacturers with guaranteed distribution channels and promotional support.

Market positioning becomes particularly crucial as the smartphone replacement cycle has extended in recent years. Consumers now hold devices longer before upgrading, reducing the frequency of transactions that historically drove carrier store traffic and plan renewals. Exclusive offerings create compelling upgrade incentives that can accelerate replacement cycles among targeted customer segments.

Industry watchers note that carrier-exclusive devices carry risks alongside opportunities. If the exclusive model fails to resonate with consumers or receives negative reviews, the strategy could backfire by associating the carrier with an unsuccessful product. Conversely, a well-received exclusive can generate significant media attention and word-of-mouth marketing that extends beyond paid promotional efforts.

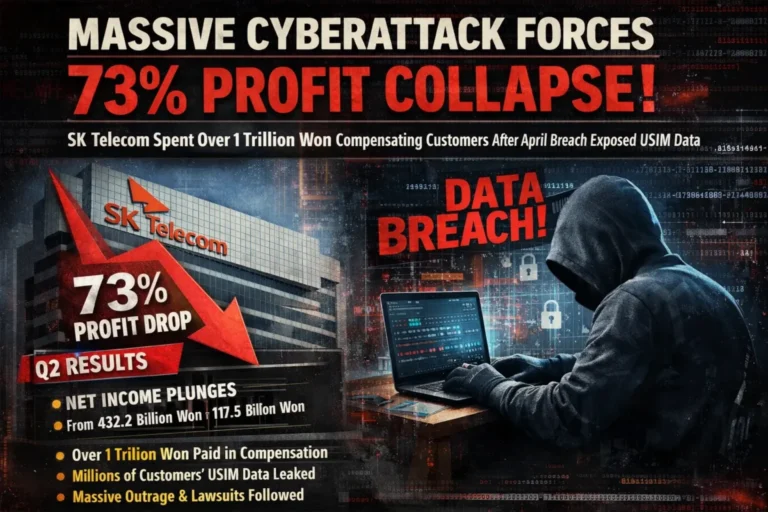

Also Read : Data Breach Destroys SK Telecom Profits by 73 Percent

Analyst Perspectives on Telecom Strategy

Telecommunications industry analysts have offered mixed assessments of exclusive device strategies, noting both the potential benefits and inherent limitations. While such initiatives can create short-term differentiation, they ultimately depend on consumer perception of the device’s value proposition relative to widely available alternatives.

Financial analysts emphasize that successful execution requires balancing device subsidies against incremental revenue gains. Carriers must structure pricing and plan requirements to ensure that the economics justify potential cannibalization of existing premium customers who might have remained without the exclusive offering.

The strategy also intersects with broader industry trends toward ecosystem development. Major carriers have invested heavily in bundling wireless service with streaming entertainment, home internet, and connected device portfolios. Exclusive smartphones can serve as anchor products within these larger ecosystems, potentially increasing the total addressable wallet for carriers beyond basic wireless connectivity.

Market Impact and Consumer Implications

For consumers, carrier-exclusive devices present trade-offs between access to unique products and flexibility in service provider selection. Premium customers may benefit from differentiated hardware options, though exclusivity inherently limits choice compared to open-market device availability.

The initiative reflects how telecommunications companies are adapting business models originally built around voice services for an era dominated by data consumption and digital services. As traditional revenue sources mature, carriers increasingly seek adjacent opportunities to monetize their customer relationships and network assets.

Market dynamics suggest that exclusive device partnerships will likely remain a recurring strategy among major carriers, though success will depend on execution quality and alignment with broader consumer trends. As 5G networks continue expanding and new device categories emerge, telecommunications providers face ongoing pressure to demonstrate value beyond basic connectivity—making strategic product differentiation an enduring priority for industry leaders.

The effectiveness of AT&T’s exclusive smartphone push will ultimately be measured in customer acquisition metrics, churn rates, and ARPU trends over subsequent quarters, providing concrete data on whether product exclusivity can meaningfully influence competitive positioning in the wireless market.

Reference Links: